Our goal is to provide access to financing to as many people as possible. It is an integral part of our business to act socially responsible and to treat customers fairly and without prejudice.

Fostering financial inclusion

Since our foundation, facilitating financial inclusion has been an essential part of our mission, business strategy, processes, brand and culture. We are convinced that access to credit is a key requirement for social and financial inclusion. It provides the opportunity to invest in one’s personal development, education, professional future, or to realize personal projects.

As a consequence, we continuously improve our unique underwriting models and scoring technology to assess borrowers on parameters other than those used by banks. Thereby, we can provide lending on a more individual and differentiated basis, allowing us to bring financing to the underserved parts of the population.

This often applies to the self-employed, students, trainees, employees in probation periods, temporary workers and people with limited credit histories such as the young or migrants.

€ 43,500

Total amount financed by auxmoney, paving the way for Kai into successful self-employment

Offering responsible lending

As a platform connecting lenders with borrowers, we are particularly aware of our responsibility towards both groups. During our credit assessments, we carefully evaluate the financial situations of potential borrowers, using complex and sophisticated approaches to verify each applicant’s ability to repay a loan.

For us it is crucial to only offer a loan to potential borrowers if it is economically and socially justifiable for him or her. We understand that in the performance of our risk assessments we have a special responsibility. That is why we have drawn up clear guidelines for responsible lending in our Customer Charter.

For auxmoney, it is crucial to not only provide financial access to underserved borrowers, but also to ensure responsible lending practices across the entire credit lifecycle, e.g.,:

- Use of clear and transparent language and explanations throughout advertising and the application funnel (formalized in communication standards laid down in a dedicated customer service handbook)

- Conduct of conscientious and discrimination-free credit assessment (formalized in a credit policy and risk management handbook)

- Offering of payment protection insurances as additional security for customers

- Providing a range of information on financial management topics on the internet and digital media (financial literacy and education) Visit our Saving Tips (in German)

- Offering different payment options or advice for borrowers with payment difficulties where appropriate (financial healing)

Responsbile lending and interest rates

We create opportunities

Higher default risk translates into higher interest rates. At auxmoney, we do not want to categorically deny people with a higher risk profile access to credit. There are good economic and personal reasons that justify loans with higher interest rates. For instance, the only way many self-employed get the chance to invest in the growth of their business and their professional future is through these loans. This not only creates career prospects, but also jobs.

Our responsibility in lending

A loan is not the right solution for everyone. And not all people have a realistic self-assessment and foresee all consequences of their financial decisions. Therefore, we find it important to supplement the personal responsibility of applicants with measures to protect them. Although we give more people access to credit than traditional banks, more than half of all credit applications are rejected because individual risk of the applicant is considered too.

How a borrower’s interest rate is determined

The interest rate is mostly driven by risk profile and loan term, thereby corresponding to the individual creditworthiness of the borrower. Borrowers with higher risk profiles pay higher interest rates. In a scientific study¹, the Deutsche Bundesbank found that risk-adjusted interest rates at auxmoney are in line with the interest rate charged by banks.

¹Bundesbank Discussion Paper No 30/2016: “How does P2P Lending fit into the Consumer Credit Market?”

Ensuring employee well-being

Next to its customer base, it is essential for auxmoney to promote well-being among its employees. Actions to ensure this include mental health initiatives (e.g., external coaching), healthy lifestyle support (e.g., special sports activities, cooking classes, lectures for healthy food) and assessing an appropriate working environment in our headquarters.

Supporting well-being within society and communities

Every year our employees receive an additional vacation day to get involved in social or charitable projects. Supporting the well-being of society and communities is realized through various community engagement projects led by the auxmoney Social Impact Board.

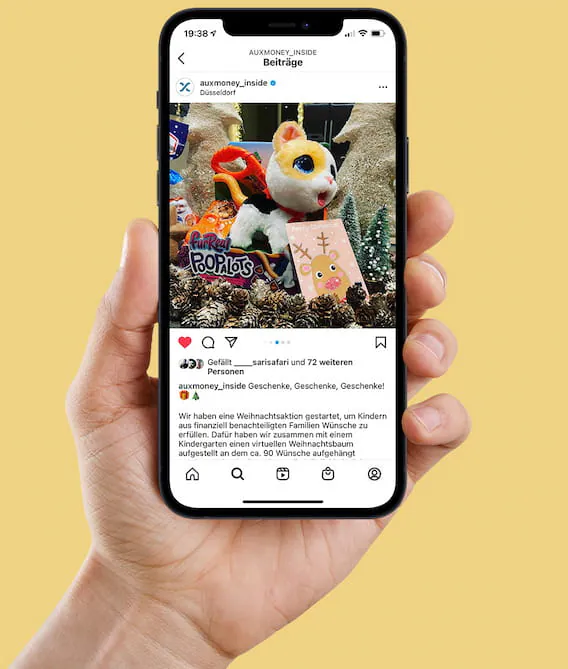

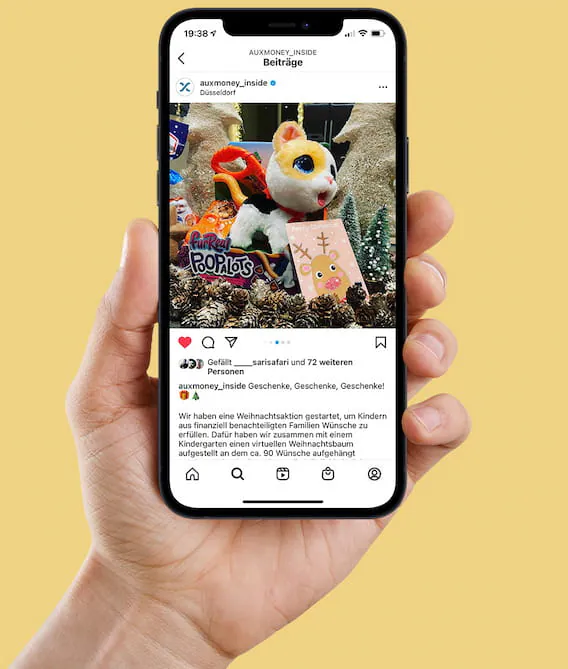

Some examples are an annual charity run to support the Förderverein zugunsten krebskranker Kinder in Krefeld (an association supporting children suffering from cancer) or the collection of Christmas gifts for children from financially disadvantaged families.

Updates concerning our Social Impact Board and other news about our company and culture can be found on our German Instagram channel auxmoney inside.

Updates concerning our Social Impact Board and other news about our company and culture can be found on our German Instagram channel auxmoney inside.

Diversity and inclusion: Promoting equal opportunities

Lastly, fostering equal opportunities as well as diversity and inclusion are integral parts of auxmoney’s business and culture: auxmoney is an active member in the Diversity Charter, regular diversity and inclusion programs are organized. Discrimination is actively monitored, and immediate action taken where required. Regular pay equity assessments are performed.